2015, a strategic year for LFB

Key events in 2015:

• Launched a new generation plant financed by a €230 million capital increase, fully underwritten by the French State, currently the sole shareholder of LFB.

• Two new products registered in Europe

• Significant investment in R&D with €81.3 million* owing to several products currently in phase III trials

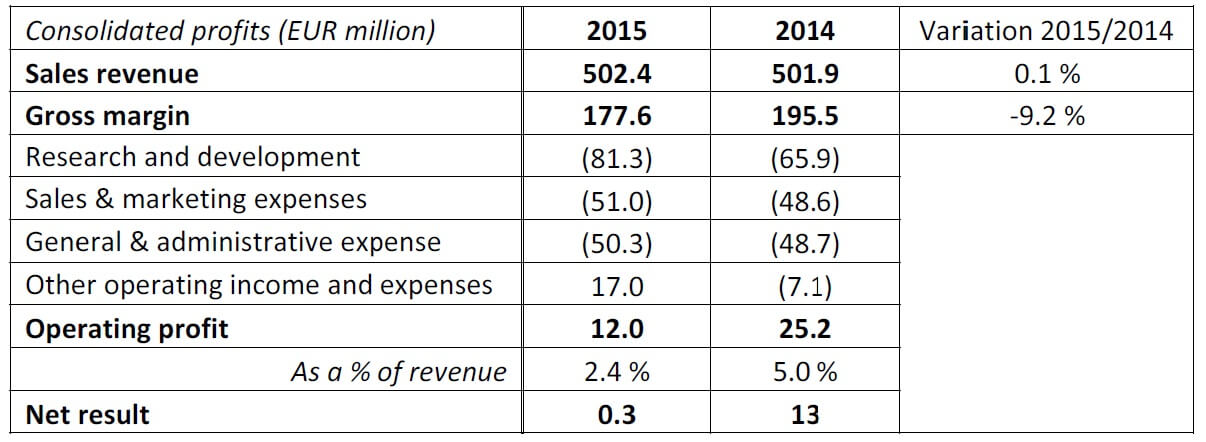

• Gross margin in decline as compared to 2014 due to the production of commercial batches for phase III products

• Turnover of €502.4 million, stable in comparison to 2014

Christian Béchon, Chief Executive Officer of L.F.B S.A. declared:

“In 2015, the key milestones have been successfully achieved. It has been a historic and productive year for

the future of LFB.”

An unprecedented increase in capital in order to finance the group’s development

As part of the group’s strategic development, LFB’s shareholder (the French State) decided in October to underwrite an increase in LFB’s share capital by €230 million. The share capital of the company now stands at €280 million. To meet the financing needs of LFB’s development project, on 5 January 2016 LFB issued a senior bond of €124 million. These funds will enable the construction of a ‘new generation’ plant in Arras. This flagship project, representing an investment of approximately €300 million, will enable LFB to triple its global production capacity in 2020 with facilities aimed at manufacturing for the whole world.

LFB is also developing its sites in Alès (Gard) and Charlton (USA), establishing bio-production facilities for recombinant medicines in development.

2015 turnover – growth in international sales

At €502.4 million, turnover is relatively stable as compared to 2014. For the second successive year, the group’s turnover exceeded €500 million, with the international side business continuing to grow. Despite a 3.2 % decline in turnover in France during 2015, international sales rose by €12.1 million (+8.7%), reaching €152 million. This figure represents 30% of consolidated turnover (28% in 2014).

Operational earnings decline in order to finance strategy

Research and development costs are increasing rapidly (€81.3 million), owing to the large number of phase III trials in progress. Various strategic projects reached significant milestones. In 2015, two new LFB products, a 10% immunoglobulin and a fibrinogen have been subject to a mutual recognition in procedure in Europe with the Paul Ehrlich Institute as the referral agency. Two other recombinant products are currently at the end of phase III. At the same time, LFB is planning to manufacture product batches for launch, which has had an impact on earnings. In 2015, the group posted encouraging operational income (€17 million), notably owing to its holding in the bio-tech company TG Therapeutics Inc. The positive operational earnings (€12.0 million) is down as compared to that of 2014 (-13.2 million) due to a decline in gross margins and increased development costs. Despite this unprecedented effort, net earnings remain positive at €0.3 million.

About LFB Group

LFB is a biopharmaceuticals group that develops, manufactures and markets biological drugs indicated in the treatment of serious and often rare conditions across a range of major treatment areas including immunology, haemostasis and intensive care. Ranked sixth in the world in the field of plasma-derived medicinal products, LFB Group is also a European leader in the development and production of proteins and innovative biotech treatments, with a global workforce of 2111 employees.

https://www.groupe-lfb.com

LFB SA

Sandrine Charrières – Communications Director

+33 (0)1.69.82.72.80 – charrieres@lfb.fr

David Loison – Financial Affairs Director

+33 (0)1.69.82.70.20 – loisond@lfb.fr

Havas Worldwide

Jeanne Bariller

+33 (0)6.15.51.49.40 – jeanne.bariller@havasww.com